Saturday, July 11, 2009

Friday, July 10, 2009

Video Update 米国株式市況 7月10日09年

今日は: バーナンキ連銀議長、ブルームバーグ・エコノミスト予想、 (CVX)シェブロン、(COP)コノコ・フィリプス、その他。

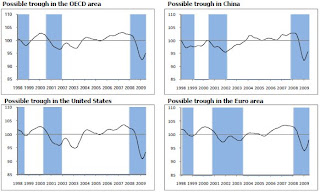

経済データでは:貿易収支、輸入物価指数、ミシガン大学消費者マインド指数、OECD景気先行指数

Thursday, July 9, 2009

Video Update 米国株式市況 7月9日09年

今日は: (TJX)テイジェイエクス、(ROST)ロススタアズ、、(TGT)ターゲット、(ARO)アエロポスタル、(M)メエイシーズ、(JWN)ノードストローム、(GPS)ギャプ、(COST)コストコ、

(AA)アルコア、ショッピングセンター国際評議会(ICSC)、その他。

経済データでは:新規失業保険申請件数、卸売在庫

新規失業保険申請件数

もう一つのポイントは、雇用統計は遅行指標だが、新規失業保険申請件数は先行指標であること。そこで、季調無しのデータを前年同期比ベースでグラフ化した物が一番下にあります。これで見ても2月辺りでピークを打ち、かなり早いスピードで下がっている。

Source: U.S. Dept of Labor, Federal Reserve Bank of St. Louis, Briefing.com

Wednesday, July 8, 2009

Video Update 米国株式市況 7月8日09年

今日はG8会議、IMF世界経済成長予想、商品先物規制強化、消費者信用残高、国債入札、(BAC)バンク・オブ・アメリカ、(ABX)バリック・ゴールド、(CME)シイーエムイー・グループ、(ICE)インターコンチネンタル・エクスチェインジ、(FDO)ファミリー・ダーラー・ストア、(TSCO)トラクター・サプライ、(PBG)ペプシ・ボトリング、(AA)アルコア、PPIP、その他。その他。

**今日のvideoでいくつか言い忘れた点があります。まず、三時過ぎにリバウンドしたきっかけのひとつは予想ほど下がらなかった5月分の消費者信用残高 [予想-$75.0億に対し、実際の金額は-$33.0億]。あと、小売が買い戻されていたのはFDO, TSCOなどの好決算と、明日発表されるチェインストア・セールスに対するspeculationもあったと思います。最後に、商品先物規制強化の話しで(CME)シイーエムイー・グループ、(ICE)インターコンチネンタル・エクスチェインジなど、取引所の株が昨日から下げています。

PPIP 公式発表

PPIP公式発表。米財務省のサイトはこちら。

Source: U.S. Treasury

July 8, 2009

TG-200

Joint Statement by Secretary of the Treasury Timothy F. Geithner,Chairman of the Board of Governors of the Federal Reserve System Ben S. Bernanke, and Chairman of the Federal Deposit Insurance Corporation Sheila Bair on the Legacy Asset Program

To view the Letter of Intent and Term Sheets, please visit link.

To view the Conflict of Interest Rules, please visit link.

To view the Legacy Securities FAQs, please visit link.

The Financial Stability Plan, announced in February, outlined a framework to bring capital into the financial system and address the problem of legacy real estate-related assets.

On March 23, 2009, the Treasury Department, the Federal Reserve, and the FDIC announced the detailed designs for the Legacy Loan and Legacy Securities Programs. Since that announcement, we have been working jointly to put in place the operational structure for these programs, including setting guidelines to ensure that the taxpayer is adequately protected, addressing compensation matters, setting program participation limits, and establishing stringent conflict of interest rules and procedures. Recently released rules are detailed separately in the Summary of Conflicts of Interest Rules and Ethical Guidelines.

Today, the Treasury Department, the Federal Reserve, and the FDIC are pleased to describe the continued progress on implementing these programs including Treasury's launch of the Legacy Securities Public-Private Investment Program.

Financial market conditions have improved since the early part of this year, and many financial institutions have raised substantial amounts of capital as a buffer against weaker than expected economic conditions. While utilization of legacy asset programs will depend on how actual economic and financial market conditions evolve, the programs are capable of being quickly expanded if these conditions deteriorate. Thus, while the programs will initially be modest in size, we are prepared to expand the amount of resources committed to these programs.

Legacy Securities Program

The Legacy Securities program is designed to support market functioning and facilitate price discovery in the asset-backed securities markets, allowing banks and other financial institutions to re-deploy capital and extend new credit to households and businesses. Improved market function and increased price discovery should serve to reinforce the progress made by U.S. financial institutions in raising private capital in the wake of the Supervisory Capital Assessment Program (SCAP) completed in May 2009.

The Legacy Securities Program consists of two related parts, each of which is designed to draw private capital into these markets.

Legacy Securities Public-Private Investment Program ("PPIP")

Under this program, Treasury will invest up to $30 billion of equity and debt in PPIFs established with private sector fund managers and private investors for the purpose of purchasing legacy securities. Thus, Legacy Securities PPIP allows the Treasury to partner with leading investment management firms in a way that increases the flow of private capital into these markets while maintaining equity "upside" for US taxpayers.

Initially, the Legacy Securities PPIP will participate in the market for commercial mortgage-backed securities and non-agency residential mortgage-backed securities. To qualify, for purchase by a Legacy Securities PPIP, these securities must have been issued prior to 2009 and have originally been rated AAA -- or an equivalent rating by two or more nationally recognized statistical rating organizations -- without ratings enhancement and must be secured directly by the actual mortgage loans, leases, or other assets ("Eligible Assets").

Following a comprehensive two-month application evaluation and selection process, during which over 100 unique applications to participate in Legacy Securities PPIP were received, Treasury has pre-qualified the following firms (in alphabetical order) to participate as fund managers in the initial round of the program:

AllianceBernstein, LP and its sub-advisors Greenfield Partners, LLC and Rialto Capital Management, LLC;

Angelo, Gordon & Co., L.P. and GE Capital Real Estate;

BlackRock, Inc.;

Invesco Ltd.;

Marathon Asset Management, L.P.;

Oaktree Capital Management, L.P.;

RLJ Western Asset Management, LP.;

The TCW Group, Inc.; and

Wellington Management Company, LLP.

Treasury evaluated these applications according to established criteria, including: (i) demonstrated capacity to raise at least $500 million of private capital; (ii) demonstrated experience investing in Eligible Assets, including through performance track records; (iii) a minimum of $10 billion (market value) of Eligible Assets under management; (iv) demonstrated operational capacity to manage the Legacy Securities PPIP funds in a manner consistent with Treasury's stated Investment Objective while also protecting taxpayers; and (iv) headquartered in the United States. To ensure robust participation by both small and large firms, these criteria were evaluated on a holistic basis and failure to meet any one criterion did not necessarily disqualify an application.

Each Legacy Securities PPIP fund manager will receive an equal allocation of capital from Treasury. These Legacy Securities PPIP fund managers have also established meaningful partnership roles for small-, veteran-, minority-, and women-owned businesses. These roles include, among others, asset management, capital raising, broker-dealer, investment sourcing, research, advisory, cash management and fund administration services. Collectively, the nine pre-qualified PPIP fund managers have established 10 unique relationships with leading small-, veteran-, minority-, and women-owned financial services businesses, located in five different states, pursuant to the Legacy Securities PPIP. Moreover, as Treasury previously announced, small-, veteran-, minority-, and women-owned businesses will continue to have the opportunity to partner with selected fund managers following pre-qualification. Set forth below is a list (in alphabetical order) of the established small-, veteran-, minority-, and women-owned businesses partnerships:

Advent Capital Management, LLC;

Altura Capital Group LLC;

Arctic Slope Regional Corporation;

Atlanta Life Financial Group, through its subsidiary Jackson Securities LLC;

Blaylock Robert Van, L.L.C.;

CastleOak Securities, LP;

Muriel Siebert & Co., Inc.;

Park Madison Partners LLC;

The Williams Capital Group, L.P.; and

Utendahl Capital Management.

In addition to the evaluation of applications, Treasury has conducted legal, compliance and business due diligence on each pre-qualified Legacy Securities PPIP fund manager. The due diligence process encompassed, among other things, in-person management presentations and limited partner reference calls. Treasury has negotiated equity and debt term sheets (see attached link for the terms of Treasury's equity and debt investments in the Legacy Securities PPIP funds) for each pre-qualified Legacy Securities PPIP fund manager. Treasury will continue to negotiate final documentation with each pre-qualified fund manager with the expectation of announcing a first closing of a PPIF in early August.

Each pre-qualified Legacy Securities PPIP fund manager will have up to 12 weeks to raise at least $500 million of capital from private investors for the PPIF. The equity capital raised from private investors will be matched by Treasury. Each pre-qualified Legacy Securities PPIP fund manager will also invest a minimum of $20 million of firm capital into the PPIF. Upon raising this private capital, pre-qualified Legacy Securities PPIP fund managers can begin purchasing Eligible Assets. Treasury will also provide debt financing up to 100% of the total equity of the PPIF. In addition, PPIFs will be able to obtain debt financing raised from private sources, and leverage through the Federal Reserve's and Treasury's Term Asset-Backed Securities Loan Facility (TALF), for those assets eligible for that program, subject to total leverage limits and covenants.

Legacy Securities and the Term Asset-Backed Securities Loan Facility

On May 19, 2009, the Federal Reserve Board announced that, starting in July 2009, certain high-quality commercial mortgage-backed securities issued before January 1, 2009 ("legacy CMBS") would become eligible collateral under the TALF. The Federal Reserve and the Treasury also continue to assess whether to expand TALF to include legacy residential mortgage-backed securities as an eligible asset class.

The CMBS market, which has financed approximately 20 percent of outstanding commercial mortgages, including mortgages on offices and multi-family residential, retail and industrial properties, came to a standstill in mid-2008. The extension of eligible TALF collateral to include legacy CMBS is intended to promote price discovery and liquidity for legacy CMBS. The announcements about the acceptance of CMBS as TALF collateral are already having a notable impact on markets for eligible securities.

Legacy Loan Program

In order to help cleanse bank balance sheets of troubled legacy loans and reduce the overhang of uncertainty associated with these assets, the FDIC and Treasury designed the Legacy Loan Program alongside the Legacy Securities PPIP.

The Legacy Loan Program is intended to boost private demand for distressed assets and facilitate market-priced sales of troubled assets. The FDIC would provide oversight for the formation, funding, and operation of a number of vehicles that will purchase these assets from banks or directly from the FDIC. Private investors would invest equity capital and the FDIC will provide a guarantee for debt financing issued by these vehicles to fund asset purchases. The FDIC's guarantee would be collateralized by the purchased assets. The FDIC would receive a fee in return for its guarantee.

On March 26, 2009, the FDIC announced a comment period for the Legacy Loan Program, and has now incorporated this feedback into the design of the program. The FDIC has announced that it will test the funding mechanism contemplated by the LLP in a sale of receivership assets this summer. This funding mechanism draws upon concepts successfully employed by the Resolution Trust Corporation in the 1990s, which routinely assisted in the financing of asset sales through responsible use of leverage. The FDIC expects to solicit bids for this sale of receivership assets in July. The FDIC remains committed to building a successful Legacy Loan Program for open banks and will be prepared to offer it in the future as needed to cleanse bank balance sheets and bolster their ability to support the credit needs of the economy. In addition, the FDIC will continue to work on ways to increase the utilization of this program by open banks and investors.

###

Tuesday, July 7, 2009

Video Update 米国株式市況 7月6日09年

今日は:経済刺激策、CFTC商品先物取引委員会、ABA全米銀行協会、全米オフィス空室率、

(COP)コノコ・フィリプス、(AA)アルコア、PPIP。

デッビッド・ローゼンバーグのインタビユー

Source: CNBC

Monday, July 6, 2009

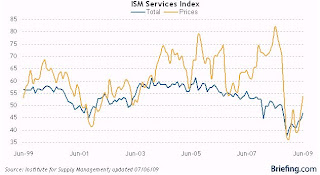

ISM非製造業景況指数

Sunday, July 5, 2009

SP500: セクターの動き(2)

この間、株式市場は横ばいだたが、5月後半からは英国の格下げの可能性が話題となり、財政赤字が悪化する米国も二の次との見方から、米金利上昇が市場の注目点となった。同時に中国の景気回復のニュースもインパクトを持った。改善する経済データと高まる金利の綱引きが続いたが、一方でドル安、コモデテー高となり、資源・エネルギー株が上昇し、マーケットは一段高いレベルヘ。

6月12日にDJIAとSP500が戻り高値を更新した辺りで資源・エネルギー株も頭打ち、デイフェンシブ株にローテーション。

まず最初に上げ基調が崩れ始めたのは個人消費関連と金融。特に小売、住宅。

金融も力が抜け始めていたが、証券株は6月まで活躍。

がんばていた商品・コモデテーも6月上旬で一服。かなり早い調整だった。